Building a Better Balanced Portfolio

Craig L. Israelsen, Ph.D. www.7TwelvePortfolio.com April 2017 It’s time for a better “balanced” portfolio. Way back when, there were two dominant investment categories (or asset classes), namely US stock and US bonds. Continue reading Building a Better Balanced Portfolio

Posted on April 1, 2017

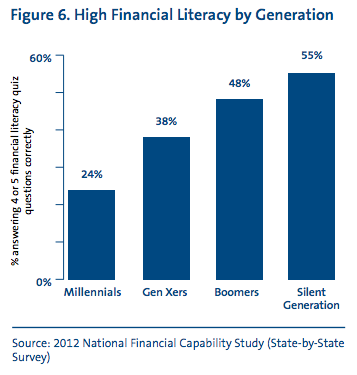

Millennials and Financial Literacy

Based on the results of a quiz sent out by FINRA, Millennials are significantly less financially literate than preceding generations. When asked five questions about economics and finance, only 24% could answer four or five questions correctly, compared to 38% of Generation Xers (see graph). Continue reading Millennials and Financial Literacy

Posted on March 23, 2017

The Role of Fixed-Income Investments and Portfolio Allocation

With the prospects of rising interest rates, investors may be re-thinking the role and purpose of fixed-income (bonds) investments within their investment portfolio. Continue reading The Role of Fixed-Income Investments and Portfolio Allocation

Posted on February 21, 2017

Taking Control of Your 401(K)

Written By: Jason T. Willms There has been a long held stigma against making changes to a 401(k) plan, but in order to maximize returns, observation and stewardship are imperative. 401(k)’s are designed to ignore short term volatility, but the intelligent investor can capitalize on these fluctuations to strengthen their portfolio for retirement. Continue reading Taking Control of Your 401(K)

Posted on January 5, 2017

Three Important Year-End Tax Planning Tips for Investors

As the close of 2016 quickly approaches, investor’s should start thinking ahead, reviewing and taking advantage of tax saving strategies. Here are three important tips that will help investor’s manage tax consequences, while helping to better manage their investment portfolio(s). Continue reading Three Important Year-End Tax Planning Tips for Investors

Posted on December 2, 2016

Concentrated Portfolios – The Elephant in Your Portfolio

Managing a portfolio around a concentrated position(s) may be one of the most difficult concepts for investors. A “concentrated position” is an investment holding that represents a disproportionate percentage of a portfolio. Investors who choose to ignore concentrated positions within their portfolios are taking unnecessary risks. Rarely does a concentrated position resolve itself. Instead, Continue reading Concentrated Portfolios – The Elephant in Your Portfolio

Posted on September 15, 2015

Mutual Fund Share Classes

Guest Blog: Sandy Gallemore, Director and Vice President for Education, InvestEd Inc. Subscribe to the InvestEd Inc. free newsletter: http://investedinc.org/FreeNewsletter/Signup.aspx A mutual fund is a pool of money from many shareholders that is invested in stocks, bonds, or other investment assets. In general, mutual funds may be identified as those that charge a sales fee Continue reading Mutual Fund Share Classes

Posted on August 11, 2015

Security Valuation and Quantitative Analysis

For many years, security valuation was viewed as an esoteric theory, mainly left to academicians. Investors did not clearly understand, nor have the computing power, to carry out the developing theory. Today, however, times have changed. MBA’s, who have had a steady diet of quantitative investment analysis, have stormed Wall Street. Sophisticated personal computers are Continue reading Security Valuation and Quantitative Analysis

Posted on July 29, 2015

Effective Portfolio Management – Understanding Risk

One of the basic premises of investing is that investors attempt to maximize the returns from their investments. In doing so, it is assumed that investors are risk averse, that is, given a choice between two assets of equal rate of return, an investor will select the asset with the lower level of risk. Although Continue reading Effective Portfolio Management – Understanding Risk

Posted on July 16, 2015

Investment Account Manager 2: Recent Review by AAII

Here is a recent review of our software that was conducted by Hareesh N. Jayanthi who is an assistant financial analyst at AAII. If you’re unfamiliar with AAII, they are one of the best resources to get unbiased facts and effective knowledge about investing. Hareesh N. Jayanthi is an assistant financial analyst at AAII and Continue reading Investment Account Manager 2: Recent Review by AAII

Posted on June 11, 2015