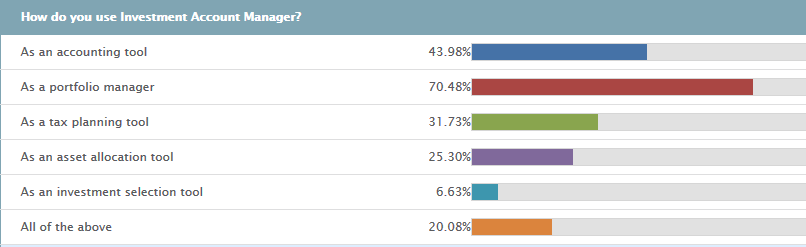

How do you use Investment Account Manager?

In a recent survey to users of the Investment Account Manager, we asked the following question: How do you use Investment Account Manager?

Possible choices for answer included:

- As an accounting tool

- As a portfolio manager

- As a tax planning tool

- As an asset allocation tool

- As an investment selection tool

- All of the above

The results received thus far for this survey question are shown here:

Provided here is a brief description of these different tools offered by Investment Account Manager:

As an accounting tool:

Investment Account Manager provides detailed transaction accounting for: purchases, sales, dividends, interest, expenses, universal stock split/dividend, spin-off and mergers, tender/exchanges, return of capital, dividend reinvestment plans, security transfers, option activity and short sales. Investment Account Manager includes more than 50 professional reports summarizing your investments: current holdings, unrealized gains/losses, sold positions & realized gains/losses (tax filing), income received (tax filing), capital gain distributions, commissions paid, security allocation, portfolio diversification, portfolio cash flow projections, tax basis, performance measurements, asset maturity schedule, transactions ledger, and more.

As a portfolio management tool:

Whether you’re a seasoned investor or a novice, you’ll find Investment Account Manager to be a comprehensive and intuitive portfolio management software tool. If you have the responsibility of overseeing and managing one or several portfolios, you’ll discover many comprehensive features that save time and help you to avoid mistakes, all the while leading to better portfolio management decisions. Investment Account Manager offers investment tracking features for a variety of asset types: cash, money market funds, US Governments, agencies, tax-exempt bonds, corporate bonds, preferred stocks, mutual funds, exchange traded funds, common stocks, options, and other investments.

As a tax planning tool:

For some investors, organizing investment records for use in preparing income taxes can be an anxiety-ridden nightmare. All those trade confirms to deal with, the income checks, figuring out gains and losses, performance – where to start! Luckily, the Investment Account Manager dramatically improves your portfolio management and investment record keeping, making income tax filing a breeze. Once organized, you’ll have the tax records and information in place to make smarter decisions. Investment Account Manager thoroughly tracks investment income received, properly tracking income distributions, gain distributions, return of capital, tax withheld, and expenses. In the case of dividends reinvested, IAM properly creates new individual tax lots for the reinvested income. Further, Investment Account Manager’s Sold Securities Report compiles important information regarding the sales of securities for a given portfolio, providing realized capital gain and loss information. Organized to clearly summarize sales activity for the period selected, this report helps users also plan future sales armed with the knowledge of gains that have already been realized in the current tax year for the portfolio.

As an allocation tool:

Two of the most important decisions an investor must make when constructing portfolios are 1) the allocation of the portfolio assets between stocks, bonds, cash and other investments and 2) the diversification of securities within those asset classes. These decisions will not only determine the risk character of the portfolio, they will also provide a major explanation for the portfolio’s return. All too often, individuals become over-weighted in a specific asset class, stock sector, or stock size and unknowingly add excessive risk to their portfolio. Investors who recognize the importance of allocation and diversification are able to identify rebalancing changes needed for a balanced and successful portfolio. Investment Account Manager provides the tools to answer these important allocation questions.

As an investment selection tool:

Investment Account Manager provides the investor with a comprehensive set of informative ratios that may be helpful in discovering undervalued securities. The data for deriving these variables can be entered manually, downloaded (in part) from the optional Quote Media stock data subscription or imported from AAII’s Stock Investor Pro software. Investors will find the set of informative ratios helpful in discovering undervalued securities, especially since the valuation ratios table can be sorted in either ascending or descending order. For example, if you wanted to sort your asset library based upon dividend yield, listing the higher yielding stocks first, with just a couple of mouse clicks you’ll have the sort order as you requested.

In summary, Investment Account Manager provides a full complement of tools and features to help you better manage your investments. Using Investment Account Manager, you’ll be better prepared to reach your long-term investment goals.

If you have any questions, feel free to post your inquiries on our Facebook page.