Managing your Investment Portfolio(s) ‘Roster’

With the NFL 2023 season nearly underway, here’s an approach for using Investment Account Manager to manage your investment portfolio much like the general manager of an NFL team manages their team roster. Considering the holdings in your investment portfolio as your ‘roster’ may help you to identify the role of each holding within your portfolio.

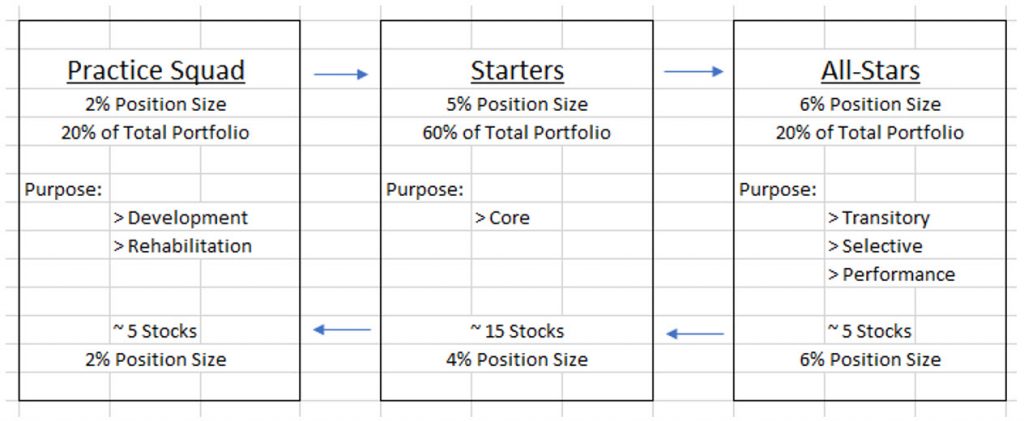

Let’s begin considering a hypothetical 25 stock portfolio, where the average position size is 4% (100%/25). This portfolio can be divided into 3 groupings (or ‘squads’):

-

-

- Practice Squad/Injured Reserve

- Starters

- All-Stars

-

Practice Squad/Injured Reserve

The Practice Squad/Injured Reserve holdings represent 20% of your portfolio, with each holding in this grouping weighted at 2%. This grouping is used for two purposes:

-

-

- Development:

- Proving ground for new investments

- Small initial positions, that typically grow to become starters

- Rehabilitation:

- Older investments that are not performing as expected

- Finite period to recover

- Development:

-

The development purpose allows for new investments to be gradually added to your investment portfolio, with a watchful eye on how well they are doing. Just as a new ‘rookie’ needs to earn more playing time based on performance, so too with these new investments. They need to perform such that they warrant their position and additional investment dollars, growing into eventual ‘Starters’, perhaps even future ‘All-Stars’.

The rehabilitation purpose provides time for older investments to improve such that they warrant being retained within your portfolio, otherwise they need to be cut (sold) from your team (portfolio), making way for new investment opportunities. Investors must realize there is an opportunity cost of holding onto underperforming stocks. Those positions, with little to no chance of getting off the ‘injured reserve’, are taking up a valuable roster position within your portfolio that can be replaced instead with new development, starters, or a potential all-star.

Starters

The Starters represent 60% of your portfolio, with each holding weighted at 5%. These are your ‘Core’ holdings: while these positions in your portfolio may have an occasional appearance as an all-star, or on injured reserve, the bulk of their time within your portfolio will be as a starter. Starters provide many important portfolio responsibilities, such as portfolio income, minimizing volatility, and portfolio allocation.

All-Stars

The All-Stars represent the final 20% of your portfolio, with each holding weighted at 6% (over-weighted). All-stars are transitory, and investors must be selective. All-stars do not come around very often, so all-star consideration is reserved for those investments with the highest probability of success, since typically an investment will only be an all-star for a portion of time while owned in your portfolio. Unlike starters, all-stars bear few portfolio responsibilities, their main objective is performance

Using Investment Account Manager, you are able to manage your investment portfolio as a ‘team roster’. This keeps a watchful eye on your practice squad/injured reserve holdings, identifying those that need replacement. You are also able to manage your core starters. And also determine if they are providing the stability required for your investment portfolio. If not, and if they should fall onto the injured reserve, you’ll have the tools necessary to identify if they can be rehabilitated, or otherwise, cut (sell) them from your portfolio. As the all-stars grow, you can manage these holdings so they move into core starters, and as the manager, you will then look for replacements to the all-star category. Finally, are the holdings on your ‘practice squad’ growing into starters or all stars? If not, time to sell these from your portfolio and look for replacements.

In Summary

Investment Account Manager allows you, as the manager of your portfolio, to:

-

-

- Manage your roster: Practice/IR v. Starters v. All-Stars

- Identify those “injured reserve” stocks that need replacement

- Maintain a “reserve list” or “watch list” for possible replacements

- Consider the tax consequences and effect on diversification and allocation of your decisions

- Organize and manage to verify stocks are meeting their goals

-

Investment Account Manager is a comprehensive, desktop-based investment portfolio management software tool that will help you to better manage your investment roster for long-term success.

A free 60 day demo version (no credit card required) is available on our website: Investment Account Manager