Tending The Rows of Your Investment Garden

With summer now under way, gardening hobbyists are busily weeding, watering and tending to their plants in hope of a bountiful crop.

All gardeners know that the better the care, the better the harvest. And, just as a gardener equally will tend to all the ‘rows’ in their vegetable or flower gardens, an investor must equally manage all the investment portfolios they own, including their taxable and non-taxable accounts.

This article will remind investors of the importance of taking an aggregate view of their investment holdings in order to verify long-term goals are within reach. By collectively managing their multiple accounts, the investor is able to better understand how all the parts fit together so as to identify their true aggregate portfolio allocation; enact rebalancing needs necessary to reach long-term goals; ‘weed and feed’ actions for the rebalancing process; and become a more confident investor.

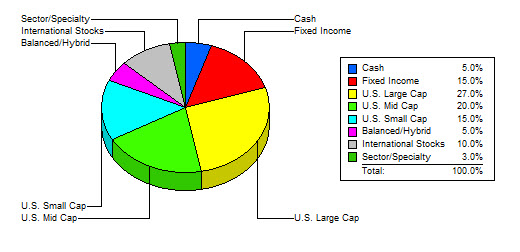

In a simple example, consider an investor with two portfolios (taxable & non-taxable). Notice below for one of these accounts individually, that when viewed independently, the allocation may look ok:

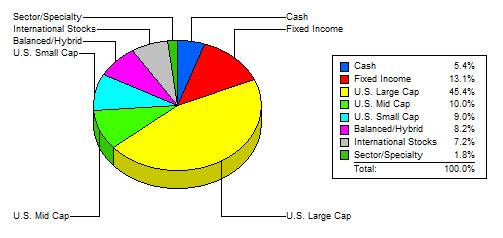

However, if investors do not consider the aggregate allocation of all their investment portfolios, it is nearly impossible to measure how well diversified in aggregate all owned portfolios are in relation to asset class, sector, and size – all important investing considerations. So, while all owned portfolios might look ok when considered on an individual basis, all too often investors unknowingly overlap their holdings by type, size or sector, and this leads to increased risk. What might that look like?

When considering all the rows of their investment garden as shown above, this investor is actually heavily concentrated in the U.S. Large Cap asset class. Not being aware that the company capitalization balance is overly skewed towards large company stocks, causing other asset classes to no longer be in line with targeted allocation goals, may result in increased risk and volatility. This too may prevent the investor from reaching the long-term growth goals for their investments, since their portfolios in aggregate may not be owning sufficient middle and small capitalization sized companies, as well as other asset classes. Investors must manage their portfolio considering all portfolios owned, how they overlap, and are working together to meet long-term goals.

The importance of reviewing your taxable with non-taxable accounts in aggregate cannot be understated. Doing so will enable you to avoid the negative impacts of over-concentrated allocations in your portfolio, and steadying returns over the long-term. Understanding in aggregate your portfolio allocations allows you to implement changes to weed and feed your portfolio ‘garden’ to maintain proper diversification and meet new objectives or goals, while avoiding concentrated risks. This is an ongoing process for long term investing success.

In summary, portfolio rebalancing, while considering all of ‘rows’ your investment garden (taxable, non-taxable) helps reduce chances for disproportionate losses if over concentrated in one asset class, stock size or stock sector. Proper allocation is a cornerstone of good portfolio management, and rebalancing helps investors to avoid portfolio ‘drift’, which is critical to your long-term investment success. Rebalancing helps investors to buy low and sell high and is an important portfolio management task for reaching long-term goals. Investment Account Manager 3 provides these vital tools for managing investment portfolios. If you have any questions, feel free to post your inquiries on our Facebook page.