The Inherent Value of Global Diversification

Highlights:

> Investors have a natural bias to invest domestically.

> Exposure to international stocks can improve portfolio performance over the long term.

> How best to invest internationally is a subject of considerable debate.

The Inherent Value of Global Diversification

Ahh, home sweet home. That feeling of security and warmth of a place we are all so familiar with. For many of us, the house we grew up in is considered sacred as we have a powerful connection to the places and environment that shaped us. In fact, researchers using fMRI brain technology found key areas of emotional processing in the brain that are activated by places that individuals have strong emotional ties to.

Investing in domestic companies can give investors a similar sense of security. The psychology of this “home bias” stems from the comfort that naturally comes from investing in companies you are personally familiar with. Investors may also find it more difficult to accurately assess the value of individual companies that are located outside of the U.S., where accounting standards are different and regulations regarding disclosures are less stringent. Finally, international investing involves special risks such as currency fluctuation and political instability.

Many of the economic justifications for a home bias have been solved by the advent of international ETFs, which allows investors to cheaply invest in a diversified portfolio of international stocks in one fell swoop. And yet, the home bias remains largely intact.

The average U.S. investor has approximately 15% invested overseas, whereas non-U.S. companies account for more than half of global market capitalization. Moreover, a recent study by MSCI found that even professional money managers exhibit a home bias – with 22% of client portfolios invested overseas.

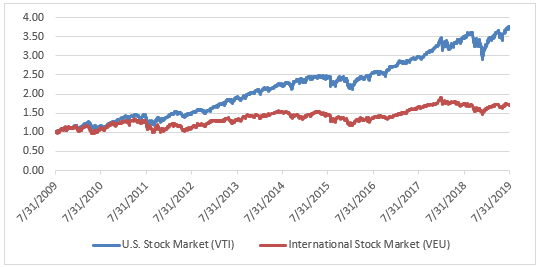

One might argue that a homeward bias by U.S. investors is warranted, given U.S. companies have on average consistently outperformed those located in other regions of the world. Over the past five years, the U.S. stock market has returned over 10% a year on an annualized basis while international stocks have returns about 2%. Over the past decade, the U.S. stock market has outperformed by nearly 200%.

While ten years may seem like a long time, it’s not nearly long enough to assure that U.S. stocks will continue to outperform the rest of the world in the years to come. Vanguard, for one, predicts that international stocks will outperform over the next decade. The money manager projects a 7%-plus annualized return for foreign shares vs. 4% for the U.S.

These expectations are supported by a concept known as mean reversion. Mean reversion refers to the theory that, over time, stock prices tend to “revert to the mean” (that is, move in the direction of their historical average price). The rationale that underlies this theory, at least in part: as the price of a stock rises, the price-earnings ratio and price-book ratio rises, which in turn puts pressure on the stock’s price (and vice versa).

Applying mean reversion to U.S. and international stock prices suggests that the strong recent performance of the U.S. stock has made U.S. stocks expensive relative to international stocks. As a result, mean reversion suggests that it is likely that at some point American shares will begin to underperform foreign stocks until equilibrium is restored.

Being highly concentrated in one geographic area of the world’s economy can also increase risk. That’s because portfolios that are concentrated in one country or region are more vulnerable to political, monetary, fiscal, and market risks. For example, when the European Union is experiencing a crisis of one sort or another, Southeast Asia’s economy might be firing on all cylinders. As a result, a diversification benefit can result from having exposure to multiple regions of the world.

The benefits of global diversification were recently confirmed by a recent research study by Bridgewater Associates. It found that a portfolio that is equally weighted across the globe generated superior risk and return results for both the stock and bond markets as compared to a U.S. only portfolio. As the study’s authors point out, “The geographically diversified portfolios do so well because they minimize drawdowns, creating a much more consistent return stream that allows for faster compounding.”

More debatable, perhaps, is whether it’s better to maintain a consistent, passive allocation to various regions of the world, or to tactically adjust how much to invest outside of the U.S. and/or which regions to invest in, in light of the current economic and political conditions.

Those who favor passive investing point to the large variety of passively managed, low cost index-tracking ETFs, which allow investors to easily invest overseas in a large number of individual countries, regions, and industries. Moreover, there is a large body of academic research that indicates passive indexes tend to outperform actively managed funds after fees are accounted for.

Active investing proponents argue that international markets are more complicated than investing domestically. In their view, index funds do not adequately account for political, liquidity, and currency risks. Active managers, on the other hand, are able to hedge against these risks in a bid to enhance risk-adjusted returns.

Which camp is right depends, in large measure, on how talented the active manager is. Unfortunately, even if an active manager has a long track record of success, it is nearly impossible to know if that success is attributable to repeatable skill, or just good luck.

As in the case of many arguments, a compromise may offer a desirable solution. The compromise approach I prefer is the use of a rules based strategy that increases or decreases the amount invested internationally based on an evaluation of a composite reading of leading economic and market indicators, such as The Conference Board’s Global Leading Economic Index.

Whatever approach one takes, one thing seems clear: long-term investors are well-served by including international stocks in their portfolios.

Thank you for reading,

Mr. Market Commentator

P.S.: If you enjoyed this post, please consider following me on Twitter

“The Market Commentator is the name given to the blog of The Milwaukee Company, LLC, a registered investment advisory firm located in Thiensville, Wisconsin. The goal of this blog is to provide information to stock and bond investors that will help clear away some of the fog that surrounds portfolio management, and give readers a clearer view of how to achieve investment success over the long term.” https://themarketcommentator.com/

Link to original article: https://themarketcommentator.com/the-inherent-value-of-global-diversification/